Introduction: Trends and Investment Outlook

The current year has demonstrated the complexity of the evolving AI industry, which highlights the highly disruptive nature of this technology. With an increasing impact of geopolitical factors and aggressive competition, investors face correspondingly growing risks in making investments in AI stocks. However, such tech juggernauts like Microsoft are estimated to generate $100 Billion from its investments by 2027, indicating a high revenue potential for AI. The same source reports a stable cost depreciation of AI that comprises a critical factor for investing and designing new solutions.

The Current State of the AI Investment Landscape

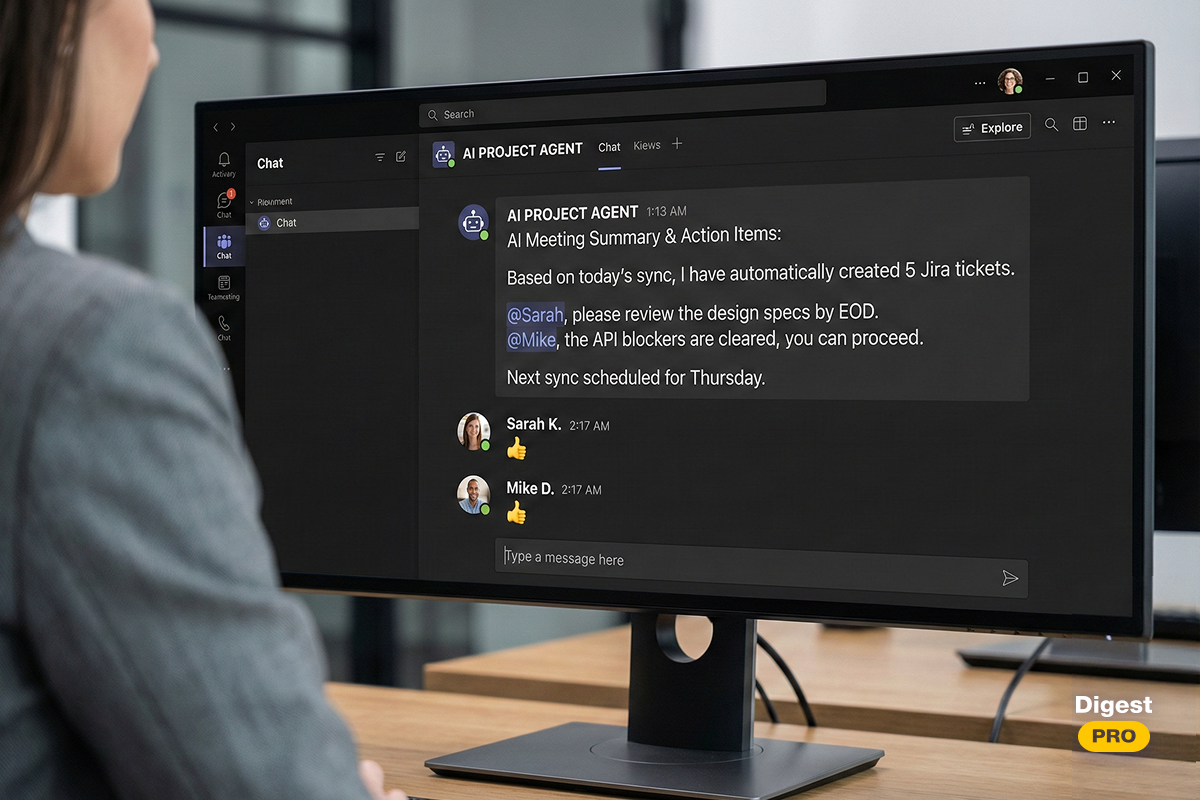

The ongoing AI hype constitutes a primary challenge for experienced and new investors since the technology has showcased early signs of transformative potential in addition to its capabilities. AI agents, for example, are one of the promising directions that fuel interest in this field while posing high risks. In this context, transformative and real-world impact comprises the driving force of investors prioritizing AI stocks. A positive outlook denotes a consistent increase in adopting the technology by enterprises with 55% in 2023 to 72% in 2024, which makes 2025 an excellent momentum for investments.

Factors that Affect AI Stocks

Geopolitics and the globalized economy have a significant impact on AI development, affecting the most influential and leading corporations. For instance, with the introduction of DeepSeek, Microsoft has canceled data center expansion in Europe. The critical factors that directly impact AI stocks can be summarized as follows:

- Hardware Manufacturing. The Nvidia case illustrates a direct dependency on microchips, and AI stocks are sensitive to fluctuations in this industry. The subsequent 17% drop in 2025 exemplifies why investors are cautious when it comes to choosing AI companies to invest in.

- Utility Costs. Energy consumption is a critical factor when it comes to projecting top AI stocks, and the mentioned Microsoft cancellation of data centers stems from the high electricity prices. The study also indicates complex ethical and economic issues by sharing the case of training GPT-3, which consumed approximately 1,287 megawatt-hours.

- International Competition. Most countries intensify the AI development race by developing their technology. Moreover, politics plays a critical role in supporting these initiatives, where DeepSeek exemplifies how new competitors create a shift in top AI stocks.

- Tariffs and Sanctions. Trade regulations, which are reactive and proactive, aim to protect markets. In this regard, globalized economies create additional pressures on tech companies, affecting the value of AI stocks.

It is possible to assert that the AI industry will continue to grow, providing excellent investment opportunities. At the same time, the outlined factors will significantly affect the performance of leading companies, which require additional consideration from investors.

The Role and Future of AI Startups

When exploring AI companies to invest in, investors should consider the increasing impact of startups on the industry. Open AI stands as a market leader in creating innovative solutions while receiving funding of $15 billion. In addition to the S&P 500, it is reasonable to expect the emergence of new promising startups worthy of attention that can become a decent investment opportunity regarding top AI stocks.

Top AI Stocks Today: 5 Companies to Consider in 2025

Despite the market volatility, this AI stocks list features top-performing tech enterprises that are highly suggested for investors. Based on their solid stock performance with corresponding strategic developments, these firms demonstrate strong potential for sustained growth of revenue and earnings per share. Moreover, these companies set and reinforce distinct trends in AI development, outlining the most demanded technologies for 2025.

1. SoundHound AI (SOUN).

SoundHound has secured its leadership in developing AI solutions for IT operations, while the company invests in new tech through active collaboration with automotive manufacturers and foodservice enterprises. With 128.42% year-to-date stock performance and projected doubled revenue in 2025, SoundHound demonstrates positive prospects for its development, making this firm one of the best AI stocks for 2025. Additionally, the company advances voice technology by offering its AI agents, a bold strategic move in the face of intense competition from tech giants like Apple, Amazon, and Alphabet.

2. Upstart Holdings (UPST)

Upstart showcases steady revenue growth in addition to adjusted profit in Q4 2024, solidifying its position among top AI stocks. The fintech industry actively exploits AI tools to set new quality standards, whereas Upstart differentiates itself by improving access to affordable credit. The 109.74% year-to-date stock performance also strengthens optimism towards the Upstarts AI lending.

3. Faro Technologies (FARO)

The reported Q1 2025 revenue of $82.9 million was a pivotal moment for Faro’s business expansion. In turn, the company’s stock performance is up to 62.63% year-to-date, which strengthens the confidence in future margins and cash flows, making Faro Technologies one of the AI companies to invest in. The recent collaboration with Topcon Corporation will sustain the growth, where the company develops AI solutions for 3D metrology.

4. Pegasystems (PEGA)

Among the top AI stocks in 2025, Pegasystems is a decent choice for investors. The company has experienced a $74 million increase in annual contract value during Q1 2025 while showcasing up to 53.72% year-to-date stock performance. Pegasystem designs AI-driven enterprise solutions that have strengthened its leadership in data analytics and automation.

5. Intuitive Surgical (ISRG)

Intuitive Surgical complements the AI stocks list with its advance in healthtech, to revolutionize surgical procedures and improve patient outcomes. The remarkable Q1 2025 revenue of $2.25 billion with 35.51% year-to-date stock performance indicates promising financial projections for this year and beyond. The designed AI solutions have gained worldwide recognition, securing its leading position in the industry.

What are AI Stocks?

AI stocks are shares of tech enterprises involved in artificial intelligence development or integration of AI systems in business operations or services. In turn, these stocks can be categorized into two main groups:

- Blue chip companies

- Small businesses

Blue chip companies demonstrate low volatility while focusing on investments or strategic partnerships. In contrast, small AI firms develop experimental technologies or innovations to forge collaborations with companies. Large enterprises provide lower but more stable returns compared to high-risk AI stocks provided by small firms.

How to Start Investing in AI Stocks

Newcomers find it challenging to make the first steps in becoming an investor. However, there are a few essential actions required to begin trading AI stocks. These steps are as follows:

- Find and explore credible brokerage services and platforms.

- Learn the terms and agreements of the chosen platform.

- Create an account.

- Start exploring and investing in AI stocks.

Additional pro tips denote a focus on beginner-friendly services like Charles Schwab, JP Morgan, Robinhood, M1 Finance, Vanguard, Fidelity, and SoFi. These options offer optimal account minimums and fees, while most of them offer educational materials and support. When it comes to finding other AI companies to invest in, users should use AI ETF databases that contain all relevant information.

Why Investors Should Focus on AI Companies

A recent article by IBM claims that AI will contribute to the generation of $4.4 trillion to the global economy, underlining its increasing market value. The reading also indicates that investors proactively explore new opportunities, while nations have adopted policies to support the innovative process. Thus, AI companies have exceptional potential to generate revenues and contribute to the revitalization of major industries.

AI Stocks Advantages

The increasing interest for AI companies to invest in stems from the unique advantages provided by these innovative solutions. While AI technology will continue to gain relevance due to its universal applicability, there are exceptional features that draw investors’ attention. They include but are not limited to:

- Disruptive Impact. AI tools or systems revolutionize industries from healthcare to finance by supporting fundamental transformation of services.

- Positive Forecasts and Shared Enthusiasm. Strong investor interest in AI stocks drives their price appreciation. The original tech trends and AI advancements further boost momentum-driven gains.

- Exceptional Innovative Potential. AI tools have become an indispensable business asset. Moreover, AI firms actively develop new products and services, indicating short and long-term investment opportunities.

Therefore, investing in AI stocks is a solid decision for investors interested in the tech industry or creating a meaningful change.

AI Stocks Disadvantages

Nevertheless, it is possible to encounter skepticism toward top AI stocks. Critics view the current AI popularity as another tech bubble, which can result in adverse outcomes for the global economy and beyond. Moreover, the disadvantages of AI stock include additional crucial nuances:

- Market Speculations. High valuations and growth expectations lead to speculative investments, especially in early-stage enterprises. In turn, inflated valuations can result in significant financial losses.

- Intensifying Competition. While tech juggernauts like Alphabet, OpenAI, Microsoft, and Nvidia aggressively advance their innovations, startups like DeepSeek can radically affect the performance of small enterprises. Market volatility remains a primary disadvantage for AI stocks.

- Political and Regulatory Impact. Legal, economic, ethical, and political landscapes directly impact the pace of AI development. Thus, potential restrictions may affect the optimistic growth and scale of operations.

It is highly recommended to consider disadvantages in addition to the latest AI news to make careful investment decisions in AI stocks.

Concluding Thoughts and Summary

While AI technology is still in its development phase, investor interest in AI companies continues to show steady growth. This article highlights the most promising AI stocks and outlines critical insights into the market, which can be summarized as follows:

- Small companies will gain the most investor attention based on their product potential and strategic collaboration.

- AI stocks are an excellent but risky choice for new and experienced investors.

- Investors should be attentive to the latest news and reports.

- Blue chip companies remain a solid investment decision.

- Despite the ongoing criticism, the AI market preserves a high revenue potential.

Consequently, 2025 is an important time for investors and firms that strive to leave their imprint on global changes. It is also a crucial year that will test the AI companies’ value while paving the way for new market leaders.

Frequently Asked Questions (FAQ)

Q: What are the top AI companies to invest in?

A: The article features SoundHound, Upstart, Faro, Pegasystems, and Intuitive Surgical as top performers in 2025.

Q: What are the most promising AI trends and developments?

A: AI agents, fintech, big data, and healthcare are trending directions for AI.

Q: What are the best AI stocks for 2025 besides the featured firms from the list?

A: Nvidia, Palantir Technologies, Adobe, and Alphabet are noteworthy options for investors.

Q: What should investors consider before investing in AI stocks?

A: It is recommended to assess their past performance data while placing an emphasis on Q1.