Beginning in 2026, new companies will enable Europe to stand independently with regard to technology and become Europe’s tech sovereignty leader.

- Global innovation leadership: Leading the world in AI sovereignty to green energy patents, these innovators create new global standards.

- Diverse founder advantage: German fintech startups with diverse founder backgrounds—entrepreneurial experience for funding + STEM education for innovation—show higher survival rates and patent filings [9].

- Resilience factors: This balanced human capital, plus early third-party endorsements and foreign partnerships (boosting survival 2.6x), builds resilient deep tech ventures complementing traditional banking [9].

In this article, we will explore the top 67 German startups that are reshaping the world in 2026, providing a deep-dive analysis of 20 market leaders and a concise strategic review of 47 additional high-growth ventures.

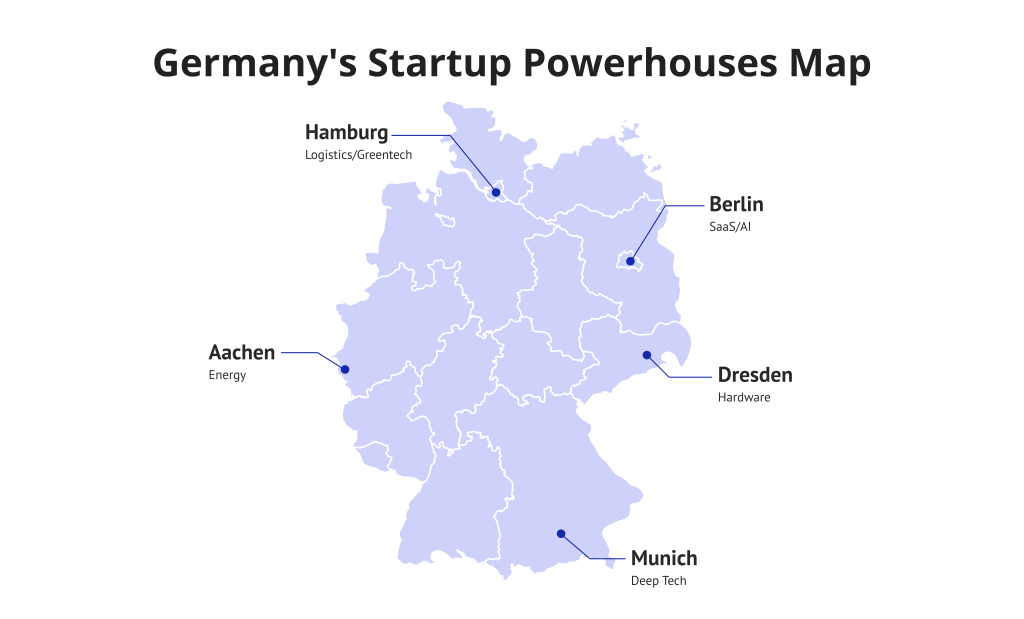

Germany’s Startup Map of Powerhouses

Consumer SaaS is led by Berlin, deep tech is dominated in Munich, and logistics are powered by Hamburg. Each of these hubs has its own set of visualization tools for forecasting Europe’s next unicorns.

The Vanguard: Deep Dive into Germany’s Top 20 Market Shapers

The following companies represent the best startups in Germany for 2026. They have secured their positions through technical excellence and strategic market positioning.

1. DeepL

DeepL develops neural machine translation software for business use. They created an algorithm that understands context better than Google Translate. Additionally, DeepL serves 10M+ active users worldwide with neural translation and strong contextual accuracy (company data).

- Industry: AI.

- Team size: Middle (600 employees).

- Headquarters: Cologne, Germany.

- Established: 2017.

- Founder: Jaroslaw Kutylowski.

- Funding: over $400M.

- Investors: IVP and Benchmark.

2. Helsing

Helsing builds artificial intelligence systems for military equipment. Their algorithms process massive data locally on tanks and aircraft without an internet connection. This unique technology enables real-time battlefield decisions for military hardware, cutting response times from minutes to seconds and saving lives through instant tactical awareness.

- Industry: Defense technology.

- Team size: Middle (250 employees).

- Headquarters: Berlin, Germany.

- Founded: 2021.

- Founders: Torsten Reil and Gundbert Scherf.

- Funding: €694M.

- Investors: General Catalyst and Saab.

3. Enpal

Enpal provides solar panel systems through a subscription service, so customers do not have to make any upfront payments to install their systems. Currently, the company has around 110,000 rooftop systems under management in Germany.

- Industry: Clean energy.

- Team size: Large (1,200 employees).

- Headquarters: Berlin, Germany

- Founded: 2017.

- Founder: Mario Kohle.

- Funding: €1.8B+.

- Investors: SoftBank and BlackRock.

4. Semron

Semron creates computer chips that utilize memcapacitor-based technology to produce energy-efficient processors. Originally developed at TU Dresden, this technology targets the exploding AI compute demands with sustainable hardware solutions.

- Industry: Semiconductor hardware.

- Team size: Small (60 employees).

- HQ: Dresden, Germany.

- Founded: 2021.

- Founder: Kai-Uwe Demasius

- Funding: €18M.

- Investors: Join Capital, HTGF.

5. Quantum Systems

Quantum Systems creates drones with the capability of vertical takeoff. The testing of the drone’s ability to change from helicopter to fixed-wing flight was successfully done with more than 260 thousand flight hours of use for reconnaissance flights.

- Industry: Unmanned systems.

- Team size: Large (450 employees).

- HQ: Gilching, Germany.

- Founded: 2015.

- Founder: Florian Seibel.

- Funding: €310M.

- Investors: Balderton and Airbus Ventures.

6. n8n

N8N is a network automation tool designed for developers. Fair-code Zapier alternative with complete developer workflow control.

- Industry: Developer tools.

- Team size: Small (80 employees).

- HQ: Berlin, Germany.

- Founded: 2019.

- Founder: Jan Oberhauser.

- Funding: $52M.

- Investors: Sequoia Capital.

7. Black Forest Labs

Black Forest Labs designs and produces the FLUX.1 model for generating images. This company had developed an artificial intelligence which is able to generate accurate representations of human anatomy (along with creating images of human body parts that do not distort) and has a top realism metrics model when comparing realism metrics to other generative image models.

- Industry: Generative AI.

- Team size: Small (45 employees).

- HQ: Freiburg, Germany.

- Founded: 2024.

- Founder: Robin Rombach.

- Funding: $31M.

- Investors: Andreessen Horowitz.

8. Personio

Personio offers an HR management platform for European mid-market companies. It automatically detects changes in local labor laws across multiple EU countries and eliminates the need for local compliance consultants.

- Industry: HR technology.

- Team size: Large (1,600 employees).

- HQ: Munich, Germany.

- Founded: 2015.

- Founder: Hanno Renner.

- Funding: $720M+.

- Investors: Index Ventures.

9. Parloa

Parloa develops voice assistants for customer service centers. The AI recognizes customer intent through shouting or background noise. Banks route initial support calls through their platform.

- Industry: Conversational AI.

- Team size: Mid-sized (160 employees).

- HQ: Berlin, Germany.

- Founded: 2018.

- Founder: Malte Kosub.

- Funding: $66M.

- Investors: EQT Ventures.

10. Grover

With a subscription-based service, Grover enables consumers to access various types of consumer electronics, such as smartphones, laptops, and smartwatches. Using a circular production method to restore previous technology allows Grover to reduce the amount of e-waste it generates and offers B2C/B2B solutions throughout Europe.

- Industry: Circular economy tech.

- Team size: Large (800 employees).

- HQ: Berlin, Germany.

- Founded: 2015.

- Founders: Martin Lorentzon & Michael Cassau.

- Funding: €500M+.

- Investors: SoftBank, Index Ventures.

Read more: CFO Trends: How Finance Leaders Are Shaping Business Strategy in 2026

11. 1Komma5°

1Komma5° provides solar services to its customers through their residential energy service, allowing them to sell excess energy produced by solar panels. When there is high demand and not enough power available from the grid, 1Komma5° can aggregate its customers’ systems of 85,000+ solar energy systems around the country into virtual power plants that will allow homeowners to sell extra power during peak times and optimize energy trading throughout Germany’s electric grid system.

- Industry: Energy technology.

- Team size: Large (900 employees).

- HQ: Aachen, Germany.

- Founded: 2021.

- Founder: Philipp Schröder.

- Funding: €300M+.

- Investors: Haniel & Co.

12. FERNRIDE

FERNRIDE develops teleoperation platforms for autonomous electric yard trucks. Their technology enables remote control of logistics vehicles on warehouse grounds, already tested with DB Schenker in Tilburg. Pioneering gradual autonomy for commercial freight.

- Industry: Autonomous mobility.

- Team size: Mid-sized (120 employees).

- HQ: Munich, Germany.

- Founded: 2019.

- Founder: Uwe Köhler.

- Funding: €50M+.

- Investors: HV Capital, Future Ventures.

13. Aleph Alpha

Aleph Alpha supplies businesses with regulated, enterprise-level language models. Company maintains an entire database of generated language models and their corresponding input source documents to maintain immutable audit trails linking each generated language model to the source documents from which they were created.

- Industry: Enterprise AI.

- Team size: Mid-sized (220 employees).

- HQ: Heidelberg, Germany.

- Founded: 2019.

- Founder: Jonas Andrulis.

- Funding: €500M+.

- Investors: Schwarz Group.

14. Isar Aerospace

Isar Aerospace develops and manufactures small vehicles (rockets) designed and manufactured to carry payloads to low-earth orbit (metric tons) into orbit from Norway. Commercially, this will allow the reduction of dependency on SpaceX for launch date schedules by European payload owners.

- Industry: Space technology.

- Team size: Mid-sized (160 employees).

- HQ: Munich, Germany.

- Founded: 2018.

- Founder: Daniel Metzler.

- Funding: $350M+.

- Investors: Lakestar.

15. Sunfire

Sunfire makes electrolyzers that can produce green hydrogen with an efficiency of up to 82%. Competitors have efficiencies of only 62%. Their clients include industrial companies, such as steel producers.

- Industry: Hydrogen technology.

- Team size: Large (420 employees).

- HQ: Dresden, Germany.

- Founded: 2010.

- Founder: Nils Aldag.

- Funding: €500M+.

- Investors: GIC.

Read more: 11 Best AI Agents for Project Management: Tools, Trends & Examples (2026).

16. Cognigy

Cognigy creates platforms for chat and voice AI agents. Their visual builder deploys enterprise agents in weeks rather than years. Banks already use the production systems.

- Industry: Conversational AI.

- Team size: Mid-sized (190 employees).

- HQ: Düsseldorf, Germany.

- Founded: 2016.

- Founder: Philipp Heltewig.

- Funding: $100M+.

- Investors: Eurazeo.

17. SaxonQ

Out in the open, SaxonQ builds portable quantum computers with nitrogen-vacancy tech and diamond-based chips. Without needing cold environments, these units keep running even when shaken—perfect for real-world conditions.

- Industry: Quantum technology.

- Team size: Small (25 employees).

- HQ: Leipzig, Germany.

- Founded: 2021.

- Founders: Prof. Marius Grundmann.

- Funding: €10M+.

- Investors: High-Tech Gründerfonds, university funds.

18. Willowprint

Willowprint is an eco-friendly producer of 3D printer filament made of agricultural waste products. The properties of these filaments are equal to those of a conventional filament; however, they can be composted at home within approximately 90 days. No adjustments are needed to a typical printer for using Willowprint’s filaments.

- Industry: Sustainable materials.

- Team size: Small (25 employees).

- HQ: Berlin, Germany.

- Founded: 2022.

- Founder: Lea Siemens.

- Funding: €5M.

- Investors: Climate funds.

19. Molabo

Starting out in 2016 just outside Munich, Molabo built something new—no one else had made a high-power electric drive running on just 48 volts yet reaching up to 300 kilowatts. Safety sits at the core; even during serious collisions, the system stays touch-safe, removing shock risks. Instead of chasing trends, they focused on low-voltage answers for cleaner transport across the globe. Automotive makers turn to them now for reliable, crash-tested electric drivetrains that don’t compromise performance.

- Industry: Electric mobility.

- Team size: Small (40 employees).

- HQ: Ottobrunn, Germany.

- Founded: 2016.

- Founders: Dr. Christian Silomon.

- Funding: €15M+.

- Investors: High-Tech Gründerfonds, industry partners.

20. Mind Companion

Mind Companion uses artificial intelligence (AI) to identify stress in the voice of individuals through voice biomarker analysis. The Mind Companion AI can detect burnout in a person two weeks prior to the onset of visible symptoms, with an accuracy rate of 92%. Mind Companion’s technology is validated through the results of clinical research studies.

- Industry: Digital health.

- Team size: Small (45 employees).

- HQ: Berlin, Germany.

- Founded: 2023.

- Founder: Dr. Sarah Weber.

- Funding: €6M.

- Investors: Earlybird VC.

This extensive review of leading startups leads us to a solid understanding of Germany’s ecosystem. However, having just a list of those businesses does not provide an exhaustive view of this industry. The market changes daily with the emergence of new businesses and the reduction or change of existing businesses. If you would like to stay informed about what is happening in this sphere, subscribe to Digest.Pro for curated startup information and the latest updates from the innovation community.

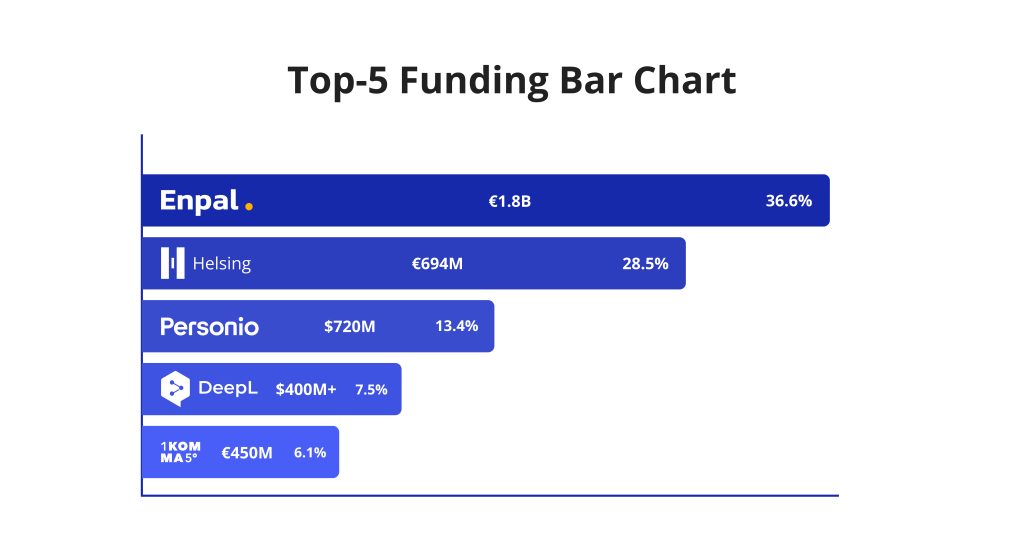

Top-5 Funding Bar Chart

Read more: Enterprise AI Adoption Barriers in 2026: Why Most Enterprises Get Stuck with Digital Transformation.

The Innovation Long-Tail: 80 High-Growth Ventures by Sector

The German market is not just about the giants. The long tail of innovation is equally impressive. The following sectors show where the next wave of unicorn startups in Germany will emerge.

AI, Enterprise SaaS & Software Infrastructure

The software-as-a-service (SaaS) market is maturing. We see a move toward “sovereign” infrastructure that protects data.

Startup | Year founded | Amount raised | Distinguishing feature |

scalestack | 2023 | €12M+ | AI-native ERP for scale-ups |

|

Jina AI |

2020 |

$38M+ |

Multimodal search for unstructured data. |

|

LeanIX |

2012 |

$120M+ |

Enterprise Architecture Management (EAM) leader. |

|

Usercentrics |

2018 |

$20M+ |

Leading Consent Management Platform (CMP). |

|

Contentful |

2013 |

$350M+ |

Headless CMS for cross-platform delivery. |

|

Camunda |

2008 |

$100M+ |

Developer-friendly workflow orchestration. |

|

Mambu |

2011 |

$440M+ |

Cloud-native “composable” banking core. |

Read more: Best AI Project Management Tools in 2026: Benefits, Key Features, and How to Choose

FinTech & The Future of Digital Assets

FinTech remains a cornerstone of the list of startup companies in Germany.

|

Startup |

Year Founded |

Amount Raised |

Distinguishing Feature |

|

Raisin |

2012 |

$250M+ |

Cross-border savings and investment platform. |

|

Solaris |

2016 |

$400M+ |

Embedded banking (BaaS) with a full license. |

|

Moonfare |

2016 |

$185M+ |

Access to top-tier PE funds for individuals. |

|

Moss |

2020 |

$150M+ |

Integrated corporate cards and accounting. |

|

Taxfix |

2016 |

$330M+ |

Mobile tax filing with conversational AI. |

|

Billie |

2017 |

$150M+ |

B2B “Buy Now, Pay Later” checkout solution. |

|

SumUp |

2012 |

$1.5B+ |

Mobile point-of-sale (POS) for small merchants. |

|

Clark |

2015 |

$100M+ |

Digital insurance “robo-advisor.” |

Holding a strategic view of Western Europe’s leading hubs requires regular reports and exclusive insights. Join industry leaders and subscribe to Digest.Pro, for continuous updates on the European startup ecosystem.

GreenTech & The Energy Transition (Energiewende 2.0)

The climate crisis has fueled a surge in green tech startups in Germany.

Startup | Year founded | Amount raised | Distinguishing feature |

|

Zolar |

2016 |

$150M+ |

Digital configurator for home solar systems. |

|

Tado° |

2011 |

$150M+ |

Predictive smart heating control for homes. |

|

Marvel Fusion |

2019 |

$100M+ |

Laser-driven non-thermal fusion technology. |

|

Plan A |

2017 |

$40M+ |

Science-based ESG and carbon tracking software. |

|

Sono Motors |

2016 |

$120M+ |

Solar integration for 3rd-party vehicles. |

|

Ecosia |

2009 |

Bootstrapped |

A search engine that funds reforestation. |

|

Customcells |

2012 |

$70M+ |

Customized high-performance lithium cells. |

|

Evervolt |

2020 |

€25M+ |

Next-gen solar modules (50% efficiency). |

Aerospace, Robotics & Future Mobility

The Munich tech hub is the epicenter of this hardware-heavy sector.

|

Startup |

Year founded |

Amount raised |

Distinguishing feature |

|

Agile Robots |

2018 |

$250M+ |

Smart robotic arms with force feedback. |

|

Magazino |

2014 |

$50M+ |

Computer-vision-driven picking robots. |

|

Vay |

2018 |

$110M+ |

Teledriving (remote control) car service. |

|

Lilium |

2015 |

$1.1B+ |

Regional electric jet for medium distances. |

|

German Bionic |

2017 |

$50M+ |

Smart exoskeletons for industrial lifting. |

|

Wandelbots |

2017 |

$120M+ |

No-code programming for industrial robots. |

|

Micropsi |

2014 |

$35M+ |

AI-based adaptive control for robotic tasks. |

|

DyeMansion |

2015 |

$40M+ |

Global leader in additive manufacturing finishing. |

HealthTech & Life Sciences Innovation

Germany’s biotech history is merging with digital health innovations.

|

Startup |

Year founded |

Amount raised |

Distinguishing feature |

|

Ada Health |

2011 |

$190M+ |

AI-powered medical diagnosis assistant. |

|

Kaia Health |

2016 |

$150M+ |

Computer vision for MSK physical therapy. |

|

Vivy |

2017 |

$50M+ |

Secure mobile health record for individuals. |

|

BioNTech |

2008 |

$1.5B+ |

mRNA-based immunotherapy and vaccines. |

|

Medwing |

2017 |

$100M+ |

AI matching for healthcare staffing shortages. |

|

Patient21 |

2019 |

$150M+ |

Vertical integration of digital/physical clinics. |

|

CureVac |

2000 |

$1B+ |

RNA-based vaccine and therapy developer. |

|

Freeletics |

2013 |

$70M+ |

AI-driven fitness coaching and community. |

Industrial Tech, Robotics & Specialized Hardware

“Mittelstand 2.0” is being built by these firms.

|

Startup |

Year founded |

Amount raised |

Distinguishing feature |

|

Sennder |

2015 |

$350M+ |

Europe’s leading digital freight forwarder. |

|

Forto |

2016 |

$600M+ |

Digital logistics and sea freight management. |

|

Konux |

2014 |

$130M+ |

Predictive maintenance for railway switches. |

|

ProGlove |

2014 |

$100M+ |

Wearable barcode scanners for logistics. |

|

Blickfeld |

2017 |

$50M+ |

Solid-state LiDAR for autonomous machines. |

|

Twaice |

2018 |

$75M+ |

Predictive battery analytics (digital twin). |

|

NavVis |

2013 |

$100M+ |

Digital twin and indoor spatial intelligence. |

|

Senic |

2013 |

$10M+ |

Smart home hardware for screenless control. |

Having a strong plan for executing your ideas is the best way to make an impact on the expanding regions. Subscribe to Digest.pro to get current updates about the startup community.

Summary

The German startup ecosystem is at a pivotal point in time; 2026 will represent a challenging year for the startup ecosystem. Developers who can execute well will find a tremendous amount of opportunity; on the other hand, certain investments will be difficult and require consideration before they occur.

- Significant growth opportunities

- Government tech demand: European governments have begun to pay more attention to supporting homegrown technology as the world becomes more concerned with safety and security. Companies like Aleph Alpha and Helsing are certainly benefiting from this trend.

- Integration with industry: New-venture startups are working directly with “Mittelstand” companies to enable them to test new technologies at a very large scale.

- Availability of capital: More than ever, there is now more capital available in Germany coming from domestic sources into late-stage funding rounds, which leads to less reliance on US-based venture capital.

- Potential investment risks

- Existing regulations: Reducing regulatory barriers associated with compliance with the GDPR and the EU AI Act will lead to high compliance-related costs for early-stage ventures.

- Shortage of skilled labor: Despite job creation being at an all-time high, competition for highly skilled AI engineers remains intense with US-based tech companies.

- Product illiquidity: A poor IPO market means that unicorns lack access to liquidity for an extended period.

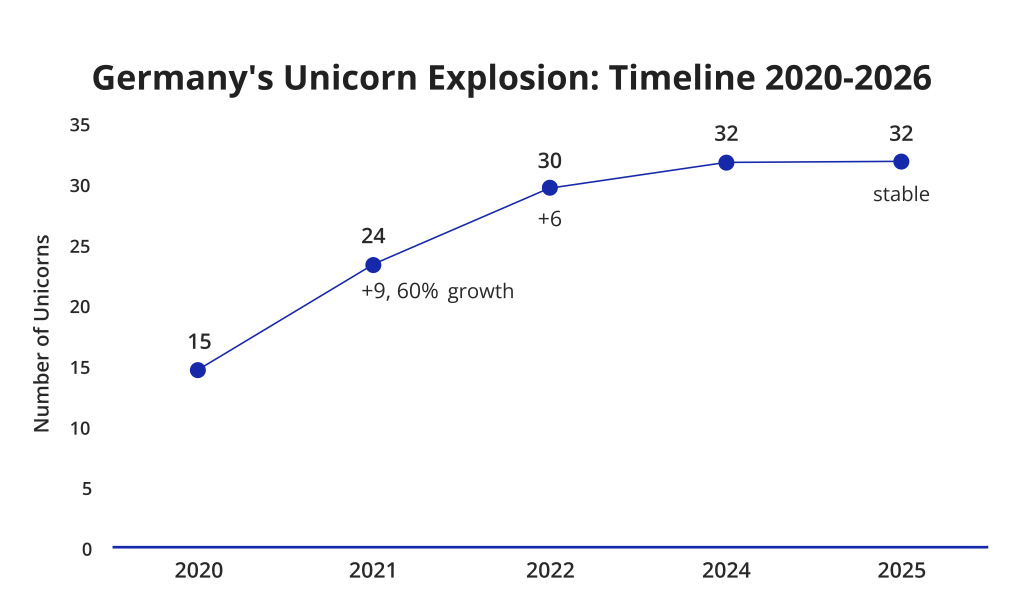

Germany’s Unicorn Explosion: Timeline 2020-2025

Our Methodology: The Data-Driven Selection Process

We selected the companies for this report using a multi-factor scoring system. More than 1,000 young businesses nationwide were studied by our group. We focused on the following key criteria:

- Strategic importance: Does the startup solve a critical European problem in energy or security?

- Financial health: We verified total funding to date and recent series funding round successes across all sectors.

- Market presence: We used metrics from Startup Ecosystem Reports to determine various market impact and traction levels.

- Growth speed: We measured headcount and revenue growth over 24 months.

- Technical superiority: We prioritized companies with unique, defensible IP in AI and robotics.

Top Startups in Germany for 2026: Frequently Asked Questions (FAQ)

Close to 7,600 new businesses now function across Germany by early 2026, primarily clustered within Berlin and Munich. During 2025 alone, more than 3500 began operations—an increase of almost one-third compared to the prior year. This rise ties closely to developments in machine-based intelligence, present during the formation of over 25% of these companies [16, 17, 18, 19].

DeepL is a top contender for 2026. With an emphasis on contextual AI, DeepL’s translations outperform Google’s, and it provides enterprise translation tools to over 10 million enterprise users across 30 languages in full compliance with the EU’s data privacy regulations. With $400 million in funding to date, DeepL may very well be targeting a unicorn trajectory in the area of Sovereign AI.

Early in 2026, Germany counted about 32 unicorns among its startup ranks. Leading names include Celonis ($13 billion) and Helsing ($14 billion). Additionally, fintech sees players such as N26 and Trade Republic shaping digital banking trends. These firms stretch across fields like mobility, AI, and business software.

Because of its partnership with renowned research organizations such as BMW and Siemens, Munich has an incredible number of academic institutions focused on developing and advancing different technologies. The defense industry in Munich also gets substantial funding to create a superior technology innovation environment and support companies involved in technology-related research in Germany and Europe.

Startup events across Germany

1) Over at Bits and Pretzels in Munich, sixteen thousand founders show up looking to make things happen—handshakes fly where ideas meet cash. Not just talk; it’s where moves get made quietly, one chat at a time. Numbers add up fast when many builders gather under one roof.

2) A startup stage in Berlin—this one spotlighting fresh SaaS ideas—kicks off under the TechCrunch Disrupt banner.

3) Fairgrounds buzz with machines that think. Hannover hosts the biggest show of its kind, where industry meets artificial intelligence.

Fresh chances pop up at these gatherings, where builders meet backers while shaping strong alliances across Germany’s launch scene. A core part of the hustle happens right here—no sidelines, just real talk and shared goals lighting the path forward.

Berlin has a larger quantity of consumer software-as-a-service companies (2,100 versus approximately 725) and relatively low costs of living. On the other hand, Munich enjoys higher total valuations of deep-tech companies compared to Berlin, since the average valuation (€2 billion) for its investor-backed unicorn companies is generally greater than other regions’ valuations (due in part to the large number of industrial/multinational company partnerships).

Yes. The increase in domestic capital for new businesses (+29% in 2025) has led to the closure of most late-stage funding rounds by utilizing KFW Bank and the High-Tech Founders Fund as major funding sources for startups, allowing Germany to reduce dependence upon US venture capital (VC) funds. In addition, the defense technology sector continues to grow.

Artificial intelligence is driving 27% of all new startups in Germany and enables an array of solutions like DeepL’s Enterprise Translation Service as well as Aleph Alpha’s compliant Large Language Models (“LLMs”) for regulated industries. The emphasis is strictly B2B (business to business), though most of the German AI startups have created applications that can assist in automating factories, providing medical imaging, and creating sovereign cloud solutions.

Examples here include the growth of defense tech (by way of Helsing’s recent €694M funding); sovereign AI (by way of how the data residency will impact companies); and the continued growth of green hydrogen investments (by way of how Sunfire’s 82% efficient electrolyzers will attract industrial off-takers).

Technology founders can get the EU Blue Card to settle in Germany. Residency here opens doors without extra hoops. In Berlin, labs and coders might claim back 25 percent on research costs. That refund comes from a rule called Forschungszulage—quiet but useful. Some startups join forces with officials through something named German Accelerator. This path links newcomers with advisors who’ve crossed into the US or Asian markets before.

One way money reaches tech start-ups comes through EXIST. Another path opens via KfW, and a third stream flows from High-Tech Gründerfonds. Funding by corporate venture groups like those tied to Siemens or Bosch often lands in Mittelstand 2.0 ventures. Meanwhile, outfits linked to accelerators—Axel Springer Plug and Play being an example—tend to step in when newer tech firms seek over €50K.

References

- Gartner (2025). “Strategic Technology Trends: Sovereign AI in Europe.”

- McKinsey & Company (2024). “The State of German Tech: Scaling the Next Unicorns.”

- StartupBlink (2026). “Global Startup Ecosystem Index 2026.”

- Google Scholar – Müller, H. (2024). “Machine Learning Architectures in German Industrial SaaS.”

- European Commission (2025). “Report on Technological Sovereignty and Digital Autonomy.”

- Tracxn (2026). Unicorn Landscapes: Western Europe Analysis.

- Crunchbase Data (2026). “Venture Capital Trends in the Munich Tech Hub.”

- Bain & Company (2025). “The Evolution of GreenTech Startups in Germany.”

- Hornuf, L., & Mattusch, M. (2024). Fintech startups in Germany: firm failure, funding success, and innovation capacity. Dresden University of Technology.

- Madi, Z., & Madi, S. (2024). The Role of Startups in Driving Economic Growth in Germany. International Journal of Economic Performance, 07(02).

- Resilience Media. State of Defence Tech 2025 Report: Funding for European Defence Startups Surpasses $2 Billion.

- EY Parthenon (2022). “Unicorn Study: Number of German Unicorns Quadrupled.” Munich Startup.

- Failory (2022). “The Full List of 39 Unicorn Startups in Germany (2026).”

- Beinsure (2025). “Largest Unicorn Startups in Germany in 2025.”

- StartupBlink (2026). “Top Unicorn Startups in Germany for 2026.”

- German Startup Association (2026). “Next Generation Report: AI Drives 27% of New Startups.” Startup Verband.

- Germany Trade & Invest (GTAI) (2026). “Record Start-up Year in Germany: 3,568 New Ventures (+29% YoY).”

- StartupBlink (2026). “7632 Top Startups in Germany for February 2026.” Global Startup Ecosystem Index.

- Startup Genome (2025). “Berlin & Munich Ecosystem Rankings.”