Now reaching a turning point by 2026, the Polish tech ecosystem has grown steadily. Global recognition followed its expansion. With focus shifting toward AI-powered solutions, DeepTech advances also emerged.

The calendar turns to 2026, marking a shift for Poland. Consequently, the country became a primary engine of European growth. Now there are over 3,300 active startups in Poland [3].

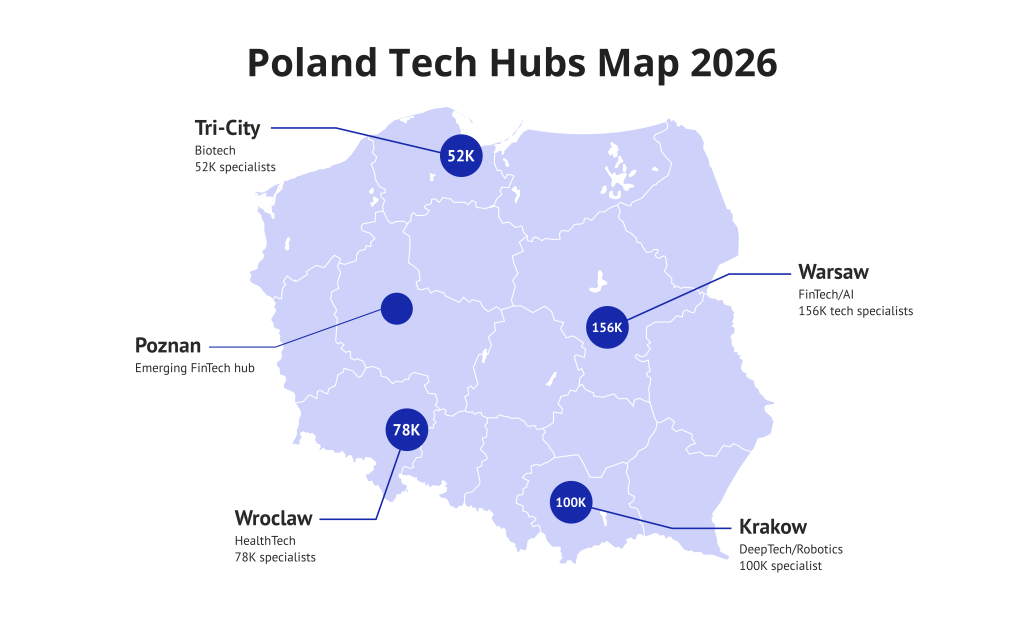

The main focus centers on FinTech Poland and HealthTech Poland. Furthermore, the Warsaw tech hub serves as a gateway for Western firms [10].

In this article, we will explore the high-growth ventures and strategic dynamics defining the best startups Poland 2026 has to offer. Moreover, we will define the best startups in Poland in 2026 that you need to know.

Polish Tech Ecosystem: Resilience and 2026 Trends

Characteristics of the current Polish market include the following:

- Resilience: It is one of the defining traits of the Polish tech ecosystem. Startups in Poland have remained on an upward valuation trajectory through the global economic changes.

- Investment momentum: In 2025, venture capital investment in Poland reached PLN 3.4 billion (~EUR 800M) across 180 transactions [4, 15], and that momentum will rally through to the 2026 calendar year.

- AI dominance: There has been a massive increase in AI applications at Polish startups, which have integrated or are beginning to integrate AI into their core business product (or service) offering, whether through IoT or MedTech.

- Institutional support: The Polish Development Fund (PFR) has launched the “Future Tech” program, supporting venture capital in Poland by providing critical liquidity.

- Decentralized growth: Krakow’s startup community has emerged as a global leader in DeepTech, even though Warsaw serves as Poland’s financial hub. Elsewhere, environmental solutions rise in Wroclaw, drawing worldwide attention. In parallel, life sciences advance steadily within Gdansk’s growing ecosystem.

- Strategic management: High-growth startups in Poland are having a difficult time with limited resources. Startup leaders will have to emphasize strategic planning and maintain flexibility and technical agility as they confront the increasing levels of uncertainty caused by high-tech projects.

Poland Tech Hubs Map 2026

Top 10 Leaders: Poland’s Unicorn Contenders

The following ten companies represent the absolute pinnacle of the Polish startup world. These firms have moved beyond the “proof of concept” stage and are now dominating their respective global niches with verified financial backing.

1. Epicstaff

Although not yet a unicorn, Epicstaff builds a multi-agent platform designed to orchestrate complex AI systems without chaos. It allows users to design smart workflows by connecting agents, tools, and actions visually. Additionally, the platform features an open, modular Python architecture for maximum flexibility. Moreover, Epicstaff supports various LLMs like ChatGPT, Claude, and Ollama. The system also includes advanced memory capabilities and custom knowledge bases. Consequently, it empowers teams to build intelligent AI agents quickly and collaboratively.

2. ElevenLabs

ElevenLabs develops high-fidelity voice synthesis technology that allows for near-instant voice cloning. As the first major AI unicorn founded by Polish talent, it dominates the global market for AI-powered solutions. Their technology has become a cornerstone of the global AI-developed software market.

| Founded | 2022. |

| Industry | Artificial Intelligence (AI). |

| Location | Warsaw/New York. |

| Funding Raised | $200M+. |

| Last Funding Round | Series С. |

| Founder | Mati Staniszewski and Piotr Dąbkowski. |

3. Ramp Network

Ramp Network builds critical infrastructure required for the crypto-to-fiat bridge. This Polish startup provides the essential tools that allow decentralized applications to interact with traditional banking systems. Their growth is a testament to the strength of FinTech Poland.

| Founded | 2017. |

| Industry | FinTech / Blockchain. |

| Location | Warsaw/London. |

| Funding Raised | $52M+. |

| Last Funding Round | Series A. |

| Founder | Szymon Sypniewicz and Przemek Kowalczyk. |

4. Docplanner

Docplanner built a worldwide digital health network linking patients to medical professionals. A veteran of the Polish tech ecosystem, they have successfully executed a strategy of international market expansion. Currently, they lead the global market for doctor bookings.

| Founded | 2012. |

| Industry | HealthTech/SaaS. |

| Location | Warsaw/Barcelona. |

| Funding Raised | $240M+. |

| Last Funding Round | Series A through Series E . |

| Founder | Mariusz Gralewski. |

Read more: CFO Trends: How Finance Leaders Are Shaping Business Strategy in 2026

5. Spacelift

Spacelift is creating a unique Infrastructure as Code (IaC) platform for today’s DevOps teams. Based in Warsaw, they tackle the complex challenge of managing cloud environments across enterprise-level operations. Spacelift has become a must-have for global software engineers.

| Founded | 2020. |

| Industry | DevOps/SaaS. |

| Location | Warsaw. |

| Funding Raised | $18.6M. |

| Last Funding Round | Series A . |

| Founder | Paweł Hytry and Marcin Wyszyński. |

6. ICEYE

ICEYE is operating the world’s biggest constellation of SAR (synthetic-aperture radar) satellites for Earth observation. While its HQ of operations is in Finland, its engineering center was developed in Poland. ICEYE provides real-time images of the Earth regardless of weather conditions and/or time of day.

| Founded | 2014. |

| Industry | SpaceTech / DeepTech. |

| Location | Warsaw/Helsinki. |

| Funding Raised | $430M+. |

| Last Funding Round | Series D. |

| Founder | Rafał Modrzewski and Pekka Laurila. |

7. Nomagic

Nomagic builds AI-based robotic pick-and-place systems to facilitate e-commerce fulfillment. Their pick-and-pack robots have the ability to manipulate goods in a human-like fashion. Nomagic continues to appear in startup news outlets for its revolutionary efficiency in the globalization of supply chains.

| Founded | 2017. |

| Industry | Robotics/AI. |

| Location | Warsaw. |

| Funding Raised | $54M+. |

| Last Funding Round | Series B Extension. |

| Founder | Kacper Nowicki, Marek Cygan, and Tristan d’Orgeval. |

8. Synerise

Synerise is an AI-based ecosystem for processing behavioral data in real time. Their platform is leveraged by retailers worldwide to create customer relationships through personalization and drive digital transactions through automation.

| Founded | 2013. |

| Industry | AI/Big Data/SaaS. |

| Location | Krakow. |

| Funding Raised | $50M+. |

| Last Funding Round | Series B. |

| Founder | Jarosław Królewski. |

Founded

9. Infermedica

A computer brain built by Infermedica guides people and doctors through confusing health choices. When clinics plug this tech into daily routines, patient visits tend to go better. Their smart programs run quietly behind the scenes in hospitals worldwide. Instead of guessing, teams get support spotting early signs of illness. These tools shape how medicine adjusts before problems grow large.

| Founded | 2012. |

| Industry | HealthTech/AI. |

| Location | Wroclaw. |

| Funding Raised | $45M+. |

| Last Funding Round | Series B. |

| Founder | Piotr Orzechowski. |

10. Booksy

Booksy powers a top spot for beauty and wellness bookings through smart software that handles appointments. Millions find it simple to grab slots thanks to tools made just for service pros. A clear leader, based in Warsaw, forms when tech meets real needs in this space. Global standards shift once people see how smooth booking can be.

| Founded | 2013. |

| Industry | SaaS/Marketplace |

| Location | Warsaw. |

| Funding Raised | $200M+. |

| Last Funding Round | Seed through Venture Round. |

| Founder | Stefan Batory and Konrad Howard. |

Read more: Instant Guide to the Best Product Management Tools for Product Managers in 2026

11. Neptune.ai

Neptune.ai builds a metadata store specifically designed for data science and AI teams. Their platform tracks and organizes experiments, ensuring that AI-developed software is reproducible and manageable at scale.

| Founded | 2017. |

| Industry | MLOps/AI. |

| Location | Warsaw. |

| Funding Raised | $11M+. |

| Last Funding Round | Series A. |

| Founder | Piotr Niedzwiedz. |

The future moves fast, so staying aware makes all the difference. Tough terrain becomes easier with precision and local awareness guiding each move. If you want to receive the freshest updates straight to your inbox, subscribe to Digest.Pro. The latest startup news help leaders across Eastern Europe make sharper choices every week.

Next Wave: 40 Rising Stars Across Polish Startups

Far from the stage, many swift new businesses quietly transform Poland’s technology landscape. Not leading charts yet, these firms form a rising current beneath the surface. So, in the coming section of the article, we will discover core information about the top 40 emerging startups in Poland.

FinTech and E-commerce Innovators

| Starup | Founded | Location | Funding | Why Watch 2026 |

|---|---|---|---|---|

|

PayPo |

2015 |

Warsaw |

$30M |

Dominant BNPL leader in the CEE region. |

|

Wealthon |

2018 |

Warsaw |

$12M |

Revolutionizing SME lending via AI credit scoring. |

|

Authologic |

2020 |

Warsaw |

$10M+ |

Biometric-first identity verification for global banks. |

|

Selmo |

2021 |

Warsaw |

$5M |

Automating social commerce for high-growth merchants. |

|

Uncapped |

2019 |

Warsaw |

$80M |

Leading revenue-based finance provider for tech. |

|

Packhelp |

2015 |

Warsaw |

$58M |

Global leader in eco-friendly custom packaging. |

|

Tidio |

2013 |

Warsaw |

$28M+ |

AI chatbots are driving SME customer engagement. |

|

Inxy Payments |

2021 |

Warsaw |

$4M |

Enterprise-grade B2B crypto-payment infrastructure. |

|

Vantage Dev |

2020 |

Wroclaw |

$8M+ |

Disrupting automated real estate finance. |

|

Rating Captain |

2019 |

Wroclaw |

$3M |

AI-driven reputation and feedback management. |

Read more: Enterprise AI Adoption Barriers in 2026: Why Most Enterprises Get Stuck with Digital Transformation

DeepTech and Cybersecurity Disruptors

| Starup | Founded | Location | Funding | Why Watch 2026 |

|---|---|---|---|---|

|

Oxla |

2020 |

Warsaw |

$11M+ |

High-performance analytical database for big data. |

|

Satim |

2012 |

Krakow |

$5M |

AI-developed satellite imagery for maritime safety. |

|

RevDeBug |

2017 |

Bydgoszcz |

$4M |

Software “flight recorder” for instant debugging. |

|

Silent Eight |

2013 |

Warsaw |

$55M |

AI-powered anti-money laundering for top banks. |

|

Alphamoon |

2020 |

Wroclaw |

$4M |

Intelligent document processing for enterprise. |

|

Surveily |

2018 |

Wroclaw |

$3M |

Computer vision for industrial safety compliance. |

|

Orbify |

2021 |

Warsaw |

$2M |

Satellite-driven environmental ESG intelligence. |

|

Quesma |

2023 |

Warsaw |

$2M |

Accelerating massive cloud-native database migration. |

|

Scanway |

2016 |

Wroclaw |

$5M |

Precision optical systems for microsatellites. |

|

RedStone |

2020 |

Warsaw |

$22.9M |

Essential cross-chain data oracles for Web3. |

GreenTech and HealthTech Poland Solutions

Startup | Founded | Location | Funding | Why Watch 2026 |

|---|---|---|---|---|

|

SunRoof |

2018 |

Lodz |

$35M+ |

2-in-1 solar roofs with AI energy management. |

|

Airly |

2016 |

Krakow |

$11.9M |

Global air quality sensor network and analytics. |

|

Jutro Medical |

2020 |

Warsaw |

$23M |

Hybrid telemedicine and physical clinic leader. |

|

StethoMe |

2016 |

Poznan |

$10M+ |

AI-powered digital stethoscope for home care. |

|

HearMe |

2020 |

Warsaw |

$4M+ |

Corporate mental health and therapy platform. |

|

Doctor.One |

2021 |

Warsaw |

$5M+ |

Direct patient communication for private practices. |

|

Saventic |

2018 |

Warsaw |

$3M+ |

AI for early diagnosis of rare genetic diseases. |

|

Proteon |

2011 |

Lodz |

$25M+ |

Bacteriophages as sustainable antibiotic alternatives. |

|

Ecobean |

2020 |

Warsaw |

$3M+ |

Transforming coffee waste into sustainable chemicals. |

|

LabFarm |

2022 |

Warsaw |

$2M+ |

Poland’s first cultivated (lab-grown) meat pioneer. |

EdTech, HR, and Lifestyle Pioneers

| Startup | Founded | Loaction | Funding | Why Watch 2026 |

|---|---|---|---|---|

|

Brainly | 2009 | Krakow | $150M | World’s largest AI-powered learning community. |

|

Coding Giants |

2015 |

Warsaw |

$12M |

Scalable programming schools for youth. |

|

Beespeaker |

2021 |

Warsaw |

$2M+ |

AI-driven verbal language learning app. |

|

Mindgram |

2021 |

Warsaw |

$10M+ |

Corporate wellness and professional coaching. |

|

ReSpo.Vision |

2020 |

Warsaw |

$5M+ |

3D sports data tracking for pro analytics. |

|

Tylko |

2015 |

Warsaw |

$45M |

AR-enabled custom furniture design and logistics. |

|

Orbital Matter |

2022 |

Warsaw |

$2M+ |

Pioneer in 3D in-space manufacturing. |

|

Binaryx |

2019 |

Warsaw |

$3M+ |

Fractional real estate blockchain investment. |

|

SentiOne |

2011 |

Gdansk |

$15M |

Conversational AI and social listening leader. |

|

inSTREAMLY |

2019 |

Warsaw |

$4M+ |

Connecting global brands with micro-streamers. |

These ventures demonstrate the immense technical depth within the local market. For real-time updates on emerging leaders, subscribe to Digest. . We provide the definitive overview of high-growth projects across Eastern Europe.

Executive Summary: Poland’s Startup Investment Opportunities in 2026

Fast steps define Poland’s path through Europe by 2026—quiet, yet sharp. Venture cash hit PLN 3.4 billion there during 2025, fueling 180 startup deals [4,15]. Quiet strength builds where others shout.

Fresh money flows into Warsaw, drawing firms that handle finance along with corporate hubs. What sets Krakow apart? A grip on DeepTech few places even come close to. Without noise, Wroclaw carves space in HealthTech, steady and out of sight.

Fresh off big funding rounds, ElevenLabs cracks artificial intelligence with a $200M+ boost. ICEYE orbits ahead in satellite imaging, backed by over $430M. Meanwhile, Docplanner reshapes clinic visits online, valued at over $240M. These names now stand tall beyond borders.

Across ten cities, fresh energy moves through labs where biology bends toward new shapes. Machines learn to walk, lift, and decide—each step tied to names once unknown. 40 of them now rise, pulling ideas from sketches into streets. Value builds behind their work: PLN 1.2B+ taking form [14]. Not noise, but motion. Not promises, but parts turning.

Methodology: Curating the Best Polish Startups

To identify the top startups in Poland, we employed a multi-factor analytical framework. We focused on long-term enterprise value rather than short-term hype. Our selection process was guided by four primary pillars.

- First, we analyzed financial velocity. We prioritized companies that secured significant Series A funding or higher in the last 18 months.

- Second, we looked for a technological moat. We placed special emphasis on Polish AI startups and DeepTech firms with proprietary IP.

- Third, we evaluated market scalability. We analyzed each Poland-based company for its ability to transition to global operations.

- Finally, we considered ecosystem impact. Recognition within recent Polish startup ecosystem reports was a key metric.

We also looked at active participation in major Polish startup events.

This methodology ensures that the top startups listed here are truly representative of Polish innovation.

FAQ: Top Startups in Poland

Poland has produced several global icons. ElevenLabs sets the pace in artificial intelligence voices worldwide. Meanwhile, patients book appointments through Docplanner across many continents. On another front, salons in America rely on Booksy daily. Every month, Brainly helps millions of learners around the world.

There is a broad range of revenue. A startup’s earnings shift dramatically depending on how far along it is. When companies are just beginning, gaining users usually matters more than making money right away. Yet things change once they grow—Polish startups that have scaled can pull in anywhere from 5 million to over 100 million dollars each year.

A startup usually races ahead fast by using tech built more like a test than a fixed thing. Because it tries many ways to earn while guessing what works best. On the flip side, regular businesses stick to clear routines that already make money. Their path stays calm, predictable, and far from experiments.

By 2026, leading startups in Poland will embed smart tech into fields that matter. ElevenLabs and Nomagic push boundaries—robotics here, creative AI there. Meanwhile, health tools evolve fast; Infermedica and Docplanner set the pace. Beyond that, companies such as Ramp Network stand out in Poland’s financial tech scene.

Dominating distant markets shows real reach—take Docplanner, for instance. Its growth pulled in vast sums from investors worldwide. Then there’s Brainly, climbing fast on a global scale. Faster than most startups ever manage, ElevenLabs became a unicorn almost overnight. On another note, Booksy carved its way into North America despite fierce competition.

More than 3,300 startups are up and running across Poland. Latest figures from 2026’s ecosystem reviews back that number. Growth has held near 15% each year since 2020.

“Startup” refers to a young company founded to solve a specific problem with a scalable solution. Innovation usage and high-speed growth are its defining characteristics. Furthermore, it involves exploring unproven business models. Linking technology with market needs is the primary goal. Also, most startups rely on venture capital for initial acceleration.

Starts with math—Poland builds sharp minds early. Top scores in global coding contests are often from its graduates. Because of that, skilled coders flood the job market here. So, startups hunting smart problem solvers settle in easily. Big names such as Google and Amazon set up research labs right in this spot. On top of that, nearby new companies gain just by being close to so much shared tech insight.

The Polish Development Fund (PFR) provides critical financial liquidity and institutional support. It manages various programs aimed at the development of startups in Poland. Through PFR Ventures, it acts as a limited partner in dozens of VC funds. Furthermore, it creates a safety net for early-stage innovation. Also, it facilitates digital transformation across the local economy.

Firstly, you can check out StartupBlink’s worldwide startup map. Also, you can try Dealroom—they show live updates for startups across Central and Eastern Europe. Funding details, where companies are based, how many people they employ—all that info lives there. Each tool tracks different angles of the ecosystem, depending on your focus.

For regional project managers working within rapidly developing markets, it’s essential that they remain apprised of all developments in order to ensure success. Subscribe to Digest.pro today and receive both a curated strategy via its newsletter as well as timely alerts when something happens.

Ramp Network and PayPo stand out at present. Building core tools for crypto—that’s what Ramp focuses on. As for PayPo, it powers ahead in buy-now-pay-later services. On a different note, firms such as Wealthon reshape small business loans by tapping into artificial intelligence. Fresh ideas grow steadily under the watchful eyes of the KNF. Because of this, firms in digital money still choose Poland first.

Home to big finance, Warsaw stands firm as Poland’s main tech player. Yet Krakow pulls ahead when it comes to DeepTech ventures. Biotech breakthroughs? Generally, the majority of companies in this industry are Wroclaw startups. E-commerce ideas bloom there, too. Not every center does everything. Not just any port town, Gdansk now pulses with new energy in shipping tech and supply chain tools. One after another, cities here carve out their own sharp niche across Poland’s rising startup map.

Yes, two stand tallest globally: Infermedica plus Docplanner. Software built by Infermedica leans on artificial intelligence to sharpen diagnosis. Linking patients with doctors—Docplanner handles that across three continents. Around such tasks, their reach stretches wide. Jutro Medical, among others, is just starting, building fresh paths blending clinic visits with digital tools. Into the mix comes artificial intelligence, shaping how care works—expected to hold strong through 2026.

Yes, 2026 projections show a 25% increase in domestic venture capital activity. Furthermore, international funds are increasing their presence in the Warsaw tech hub. This maturity reflects the rising quality of Polish founders. Consequently, Poland is now the primary gateway for capital in Eastern Europe.

References:

- StartupBlink. (2026). “Poland Startup Ecosystem—Rankings and Insights.”

- Dealroom.co. (2025). “Polish Ecosystem Report 2025.”

- AKCES NCBR AND ANTAL. (March 2024). “Acceleration market in Poland.”

- PFR Ventures. (2026). “Polish VC market outlook Q3 2025.”

- The Recursive. (2025). “Poland’s Top Funding Rounds H1 2025.”

- Czaplińska, K., & Romanowski, M. (2024). “Business Incubators and Technology Parks in Poland.”

- Kozioł-Nadolna, K. (2022). “Innovation Strategies Used by Companies in Poland During COVID-19.”

- Drzewiecki, J. (2023). “Strategy vs Business Model Approach in Polish Tech Startups.”

- Startup Poland. (2019). “The Polish Tech Scene: 5 Years.”

- Trade.gov.pl. (2025). “Poland’s Start-up Potential.”

- EU-Startups. (2025). “Poland’s 10 Promising Startups to Watch.”

- Failory. (2026). “Top 100 Poland Startups to Watch.”

- Antal & Vestbee. (2024). “Poland Acceleration Market Report.”

- Seedtable. (2026). “61 Best Startups in Poland to Watch.”

- SSK&W LAW FIRM. (2026). Polish VC Market Insights 2025 / Perspectives 2026.